2022.05.26

Blockchain and the Insurance Industry

What is Blockchain and why to use it

While blockchain is popularly associated with cryptocurrencies, like bitcoin and ethereum, companies can band together and use it as a highly secure solution allowing different entities to communicate without revealing confidential information. Blockchain, or Distributed Ledger Technology (DLT), is a method of building a decentralized network where transparency, trust, immutability and privacy can be ensured with remaining control over data.To hack or tamper a Blockchain would require simultaneous hacking of multiple computers and/or servers at the same time, which makes it highly unlikely and extremely costly.

What are research institutes saying?

Let's take for example Gartner. They estimate blockchain to be heavily adopted starting in 2023 and lead to $3.1 trillion in new business value by 2030.Quote from their CIO s guide to Blockchain: "Exploiting blockchain will demand that enterprises be willing to embrace decentralization and strategic tokenization in their business models"

Blockchain in the Insurance Industry

For the last decades different types of insurance in combination with digitalization have been responsible for gigantic revenues. However, with more information solely centralized stored in its digital format, fraudulent activities are damaging the insurance landscape and creating various problems for the industry. In other industries, blockchain is already creating some impact on fraudulent scenarios based on problems arising from overbearing digitalization.DLT has the potential and can help to transform how the Insurance companies do business. It can boost transparency, comply with regulations, and help building new products and developing new markets. Blockchain’s very specific attributes can help insurers enhance customer service, reduce cost, improve trustworthiness and much more.

Lets discuss the Top 5 insurance applications and their benefits for DLT tech:

Better fraud prevention

Insurance fraud costs Billions $40 Billion a year says FBI.

But can Blockchain tech help to reduce this cost?

Right now insurers are public available data (OSINT - "Open source intelligence") for fraud detection. Conducting OSINT investigations is a very cumbersome process and the most of the time collected data is not really thorough.With a DLT solution it would be possible to create an "insurance claims ledger" which could be shared amongst multiple insurance companies. Since all of it's data is "immutable", insurers can coordinate and share most important claims information, such as "if a claim has already been paid" and much more.

In addition algorithms can be implemented to identify suspicious behavior for claims management across different organizations thus including historical claim information. Since all information is encrypted information can be shared without revealing sensitive personal data of the insured party.

Improved trustworthiness

Trustworthiness is a build-in and one of the most important features of Blockchain.

Such a ledger would come with no "transaction charge" and could monitor and audit every single transaction and insurance related variables in real-time. Due to DLT s nature, all audit trails are completely tamper-proof with no additional effort.

Automation

Automation always means money saving, not only for the Insurance industry.

Smart contracts do not require any interaction and therefore create a massive benefit for their users. They can help to insurance companies time, effort, and in the end money by being faster and therefore more competitive.

Improved claims management

DLT tech can help to enhance claims management in several ways. The simplest one is again the use of "Smart contracts". Moving Insurance policies on a Blockchain and enhance them with "Smart contracts" would save insurers tons of money.According to BCG Blockchain tech could reduce insurers combined operating ratio by 5 to 13 percent or $200 billion.

1 An imaginary Blockchain based flight delay insurance.

Smart contracts connect to global air traffic controller databases (sample1, sample2) and check frequently on the status of the policyholders flights. If a policyholder experiences a delay confirmed by airtraffic, the smart contract automatically determines eligibility and triggers the payment for the insured upon the receipt by the policyholder.

As you can see, the whole claims process is fully automated and can run without any interaction or intermediation.

2 An imaginary Blockchain based flood insurance.

Smart contracts connect to IoT/IIoT devices/data which conduct frequent measurement of the water level of policyholders nearby rivers and lakes (UK sample). If the IoT devices report water levels above a predefined threshold Smart contracts automatically determines eligibility and again triggers the payment for the insured. Same concept can be applied on any other insurance based on technical measurable events.

This is a very good example on how 2 of the most promising technologies (IoT and Blockchain) can be combined and again run without any interaction or intermediation.

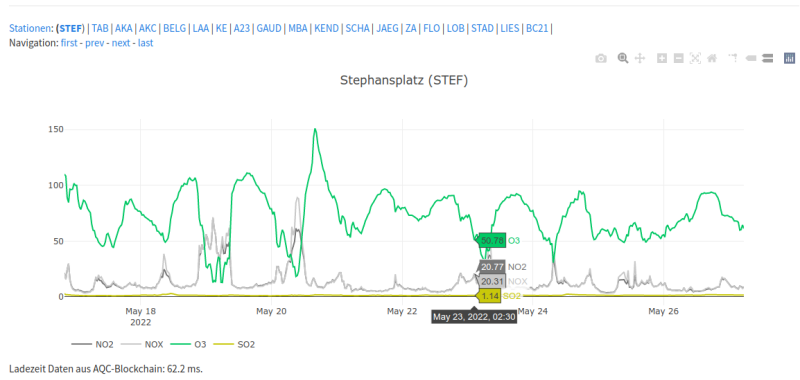

Infinite Trust Digital was involved in the developed of multiple systems which combine IoT devices/data with Blockchain applications. The Air Quality Chain is a very good example on how DLT can be used to improve environmental sustainability.

Micro insurances

Typical Micro insurance products offer coverage to individuals who have little savings. It is tailored specifically for lower valued assets and corresponding compensation. Typically such schemes invoke a very intensive administrative processes resulting in high fees for small payments.With DLT claims handling and underwriting can be heavily automated based on defined rules in micro-insurance schemes. Thus including fast and easy payouts.

P2P insurances can allow individuals or agents join together and pool their resources for mutual benefits. The most important feature of P2P insurances would be a business model that does not require any centralized authorities. The idea of P2P insurances is not new, but until now the factor of trust between unmediated parties was always an issue.

Since trustworthiness is a key feature of DLT tech today it is now possible to take a P2P business model and combine it with Blockchain technology in order to create a real disruptive P2P solution.

Claims and transactions would be processed automatically if "Smart contract defined" conditions are met. If wanted payments could be facilitated with digital wallets acting as "Digital Escrow" by storing exchangeable- and platform- specific tokens, reducing transaction costs to zero.

For more information on Blockchain tech and how to implement Blockchain applications in a real world scenario do not hesitate to contact us at office@infinite-trust-digital.com

@Copyright 2022 - Infinite Trust Digital GmbH